From

From $1,930,598

From $965,299

From $320,728

Investment advice

2023 Investment guide

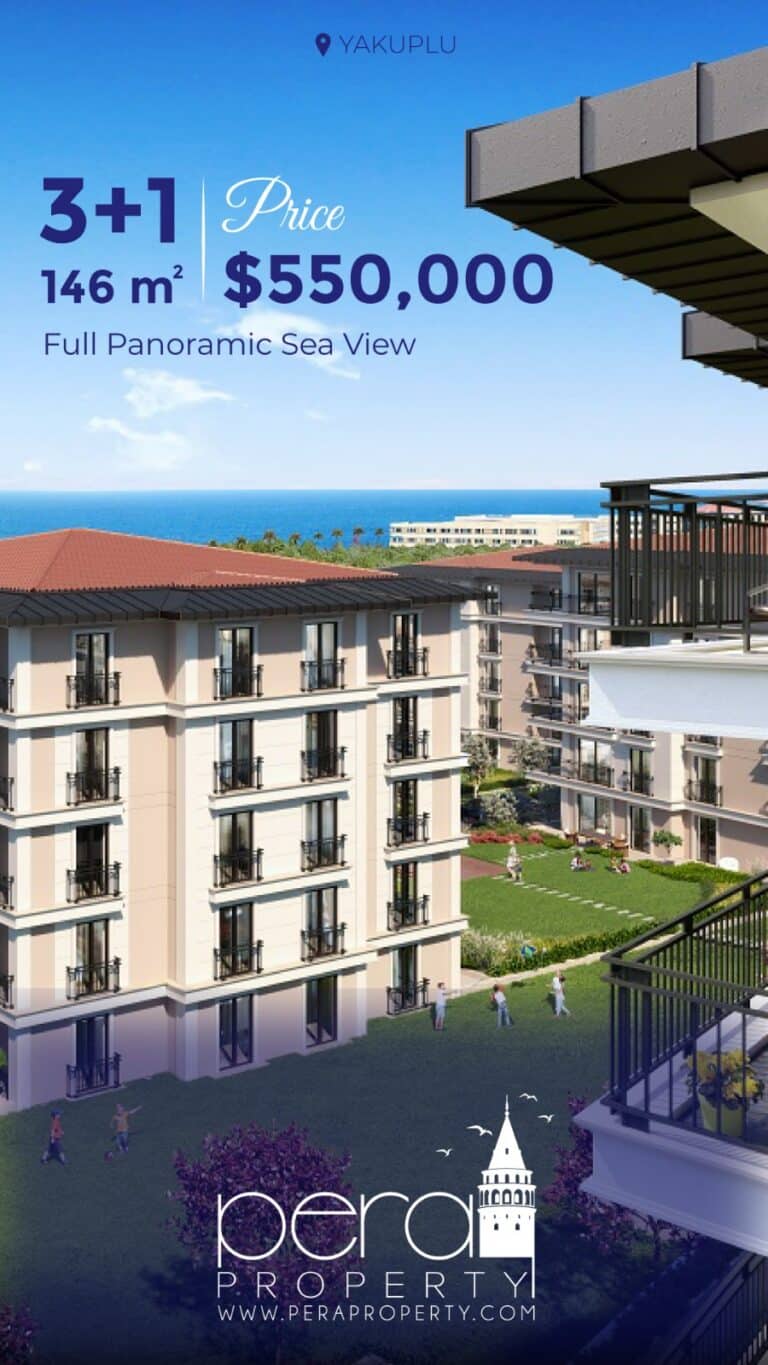

Investing in Istanbul should start with detailed market research to develop knowledge. We’ve refreshed our annual quick read reveiw of the Istanbul real estate market, taking you through essential factors in the market, and on to a whirlwind tour of Istanbul’s regions – good and bad!

D. Koray Dillioglu

Director @ Pera Property./

From

$220,000

- 1

/

From

$267,793

- 4

/

From

$515,657

- 2

/

From

$321,351

- 1

/

From

$211,743

- 3

/

From

$678,823

Special offers

Land near Istanbul !

Land near Istanbul from $65,000!

Pera Magazine

Urban Transformation in Istanbul

Urban transformation in Istanbul has gained pace with cross party support to reduce the number of risky buildings in Istanbul ASAP.

Buying in Turkey – step by step

Buying property in Turkey can be difficult. Pera Property provides a full service to ensure your Istanbul real estate is hassle free

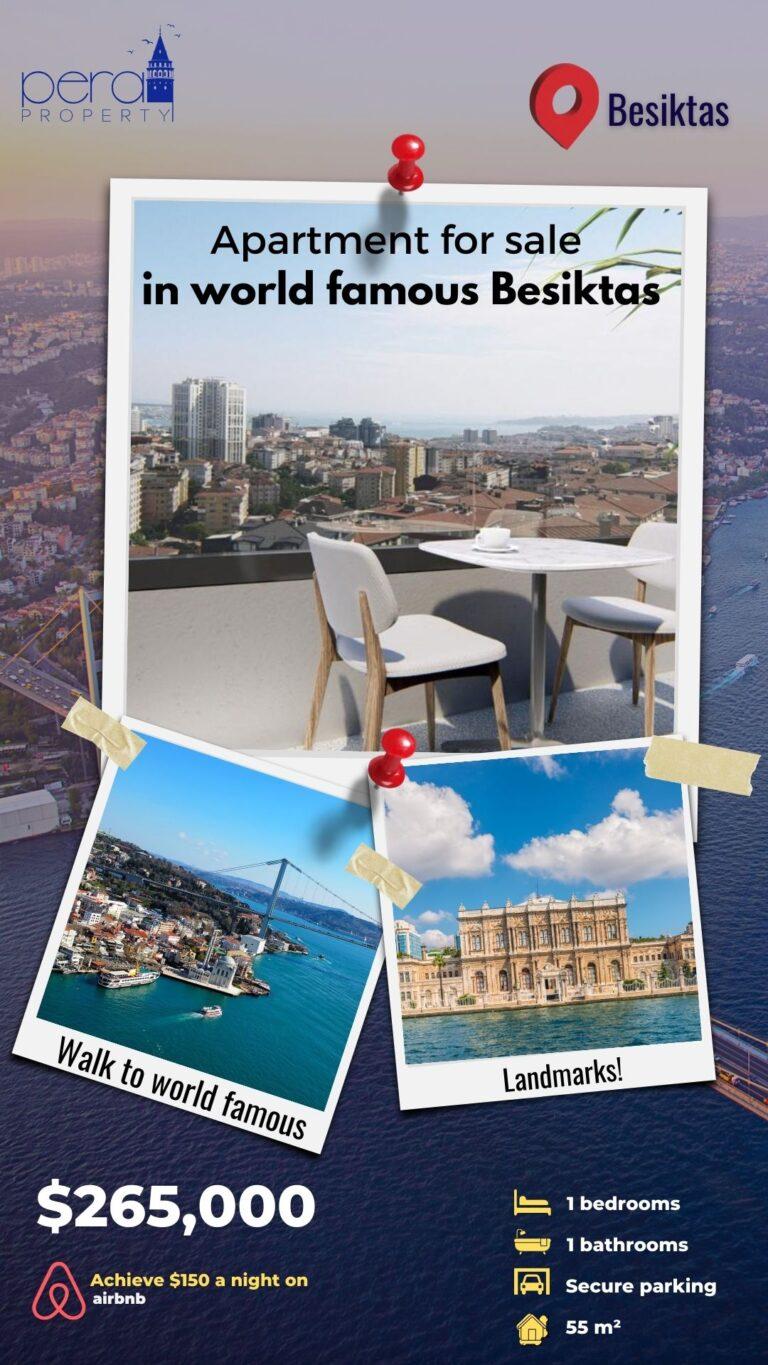

New Regulations for Short-Term Rentals in Istanbul

Short term rentals AKA Airbnb will be heavily regulated from Jan 1 2024, here is the short version of the new regulations.

Investor services

Time to sell

Prices have risen nearly 45% over the last twelve months - time to cash in? For your free property valuation, contact us now!

Rental management

Pera Property provides a bespoke management service, which takes care of all aspects of managing your much loved property. Get a free rental valuation from us today!